The High Court’s decision in Various Claimants v Mercedes-Benz Group AG & Ors [2025] EWHC 2307 (KB) demonstrates the court’s continued determination to control excessive costs in large-scale group litigation through robust budgeting reductions.

Background

The judgment concerns the second Costs Management Hearing (CMH) in the NOx Emissions Group Litigation, a series of consolidated Group Litigation Orders (GLOs) concerning claims against various vehicle manufacturers. The litigation is being case managed in tranches. The first trial (Tranche 1) on “KBA Issues” took place in October 2024. The second trial (Tranche 2) on “Prohibited Defeat Devices” (PDD) is scheduled for October 2025. The costs for these tranches were managed at the first CMH.

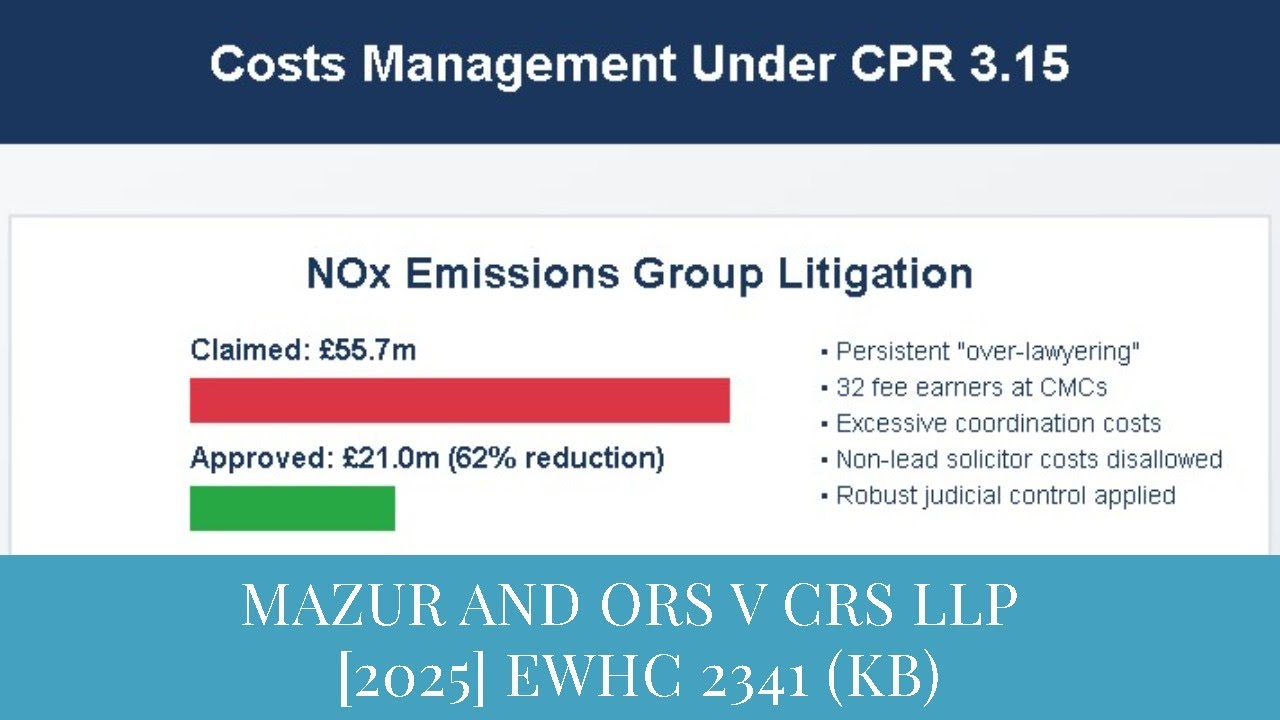

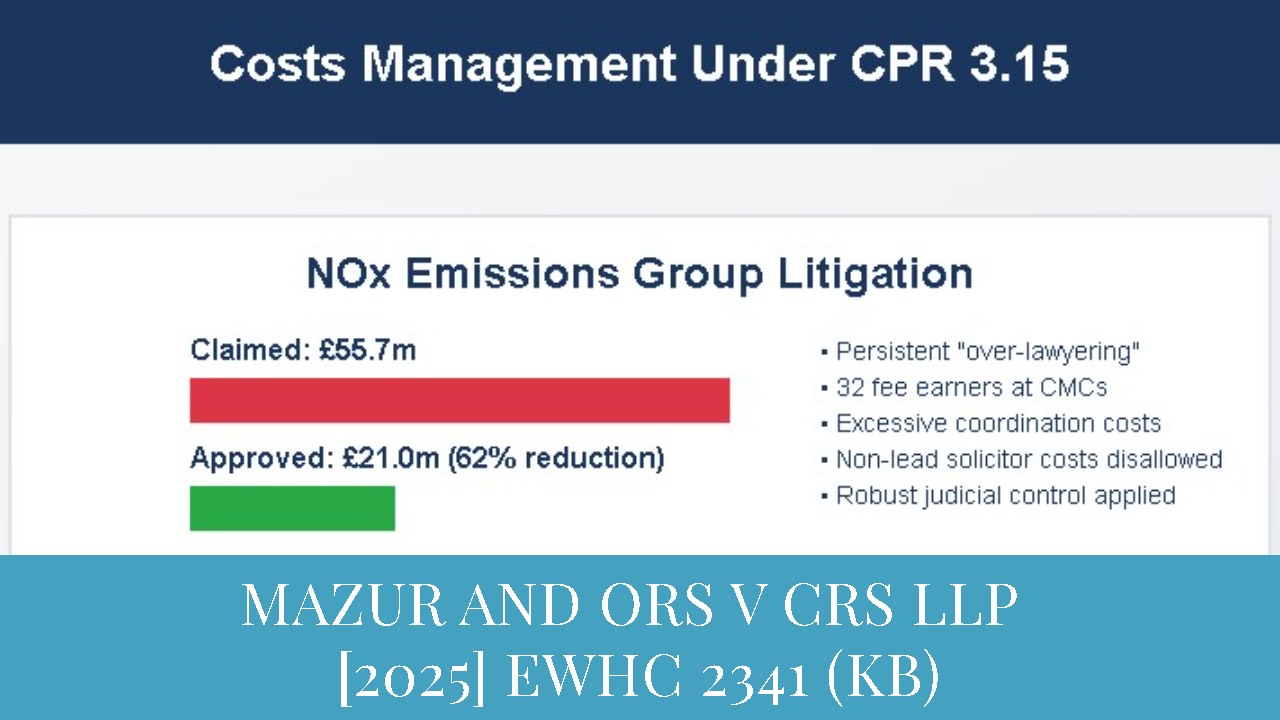

This second CMH dealt with the costs budgets for the third tranche of the litigation (Tranche 3) and a second period of general costs (Second General). Tranche 3, the “Quantum Trial”, concerns issues of causation and loss and is listed for eight weeks in October/November 2026. The Second General budget covers the period from Spring 2026 up to the Quantum Trial. The court was required to approve budgets for 63 Precedent Hs, comprising 390 costed phases, with total sums claimed of £55.7 million (claimants) and £75.8 million (defendants collectively) for Tranche 3, and £19.8 million (claimants) and £3.6 million (defendants) for the Second General phase.

The Lead GLO involves claims against Mercedes-Benz. Additional Lead GLOs (ALGLOs) involve Ford, Peugeot/Citroën (PCD), and Nissan/Renault. Claims against other manufacturers (e.g., BMW, Vauxhall, Volkswagen) are designated as Non-ALGLOs. The case management directions limited the participation of Non-ALGLOs in the upcoming trials, which was a key factor in the costs budgeting exercise. The claimants structured their budgets to distinguish between “Pan NOx” work (involving all GLOs), “Lead and ALGLO” work, and “GLO specific” work.

Costs Issues Before the Court

The primary task for the court was to determine the reasonable and proportionate budgeted costs for the future phases of the litigation, namely Tranche 3 and the Second General period. The key costs issues included:

-

- The appropriate level of reduction to the claimants’ budgets to address continued “over-lawyering”, a criticism made in the first CMH judgment.

- The relevance of the budgets approved for the longer and more complex Tranche 2 trial as a comparator for setting Tranche 3 budgets.

- Whether to allow standard figures for defendants performing similar tasks or to recognise a range of reasonable and proportionate costs.

- The recoverability of common costs claimed by numerous non-lead solicitors’ firms instructed by individual claimants within the GLOs.

- The reasonableness of the high number of fee earners the claimants had budgeted to attend hearings such as CMCs, the PTR, and the trial.

- Whether to approve budgets for the Expert Reports and ADR/Settlement phases at this stage or to defer this decision.

The Parties’ Positions

The defendants’ overarching position was that the claimants had failed to learn lessons from the first CMH and continued to advance unrealistic budgets characterised by excessive manpower and duplication. They argued that the budgets for Tranche 3 should generally be lower than those for the longer and more complex Tranche 2 trial. They criticised the claimants’ structure of involving multiple law firms and the vast number of fee earners budgeted for hearing attendance. For their own budgets, defendants generally sought to justify their figures based on the specific work required, though the claimants alleged some defendants were budgeting at lower rates than they were actually incurring.

The claimants argued they had responded to the first judgment by providing more detailed justification for their figures and by reallocating work within their budget structure. They contended that the “lived experience” of Tranche 2 had demonstrated that more work was required than initially anticipated, justifying higher figures for some Tranche 3 phases. They defended the involvement of non-lead firms, citing a solicitor’s duty to keep clients informed and the right of clients to choose their representation. For the defendants’ budgets, the claimants often made standard offers to groups of defendants (e.g., all Non-ALGLOs), arguing a single figure could be reasonable and proportionate for similar tasks.

The Court’s Decision

The court, applying the overriding objective and the principles of costs budgeting, made significant reductions to the budgets of both parties, particularly the claimants. The approved figures are set out in the conclusion below. The court’s key findings and rationale were as follows:

-

- Over-lawyering and Lessons from the First CMH: The court found that the claimants’ efforts to provide more detail did not justify the “enormous amounts of time claimed”. It upheld the criticism of “over-lawyering”, citing as an example the claimants’ budget for 32 fee earners to attend CMCs at a cost of £3.3 million. The court found the claimants’ approach, particularly the layers of representation and involvement of multiple non-lead firms, led to duplication and inefficiency.

- Comparison with Tranche 2: The court agreed with the defendants that the budgets approved for Tranche 2 were a relevant starting point and that, given the shorter length and less complex nature of the Quantum Trial, Tranche 3 budgets should generally be lower, not higher. The court expected improved cooperation and lessons learned from Tranche 2 to lead to more economical working.

- Standard Figures vs. a Range: The court held that where defendants were undertaking the same tasks, a standard figure could be reasonable and proportionate. It noted that figures within 20% of a reasonable comparator could be considered within an acceptable range. However, figures more than 20% above a reasonable comparator required specific justification, which was often lacking.

- Non-Lead Solicitors’ Costs: The court severely restricted the common costs recoverable by non-lead firms. It held that work such as keeping abreast of developments for client advice was primarily a solicitor-client matter, not recoverable between the parties. For sample claimants represented by non-lead firms, the cost of drafting witness statements or pleadings should be no more than if the work had been done by the lead solicitor.

- Hearing Attendance: The court drastically reduced the claimants’ budgets for hearing attendance. It found the number of fee earners budgeted (e.g., 9 in person and 21 remotely for CMCs) to be unreasonable. For the trial, the court approved a team of only 4 fee earners from each lead firm attending in person, with no allowance for attendance by fee earners from other firms.

- Specific Phase Reductions: The court made detailed reductions across all phases. For example, the claimants’ sought £3.3m for two CMCs was reduced to £850,000; their £1.4m for the PTR was reduced to £300,000. The defendants’ budgets were also reduced in many phases where they were found to be excessive, such as Vauxhall’s budget for reviewing statements of case.

- Deferral of Expert Reports and ADR Phases: The court declined to budget the Expert Reports phase because the scope and necessity of this evidence was still to be determined at a future CMC. The ADR/Settlement phase was also deferred because the parties’ assumptions were too far apart (£11m claimed by claimants vs. £1.8m by defendants) to make sensible budgeting possible at this stage. The court proposed to reconsider these phases in January 2026.

- Second General Costs: The court found the claimants’ claimed management costs of nearly £20m to be “frankly staggering” and illustrative of a “wildly inefficient” approach. The budget was based on assumptions of excessive monthly updates to a vast number of lawyers and clients. The court allowed only a modest sum for essential register updates and communication, significantly reducing the budget to £1.43m.

In conclusion, the court approved the following total budgets:

-

- Tranche 3: Claimants: £21,024,850.01 (from £55.7m claimed); Defendants: £48,058,002.04 (from £75.8m claimed).

- Second General: Claimants: £1,430,000.00 (from £19.8m claimed); Defendants: £1,319,114.70 (from £3.6m claimed).

CPR 3.15A | Costs Budget Revisions | Significant Developments And The Need To Act Promptly

Directly relevant as it covers CPR 3.15A budget revision applications which relate to the costs management framework applied in the NOx case

Costs Management Hearing | Unrealistic Budgets May Face Adverse Costs Orders

High Court decision (2025) discussing excessive costs budgets and judicial warnings about “unrealistic” budgets, highly relevant to the over-lawyering theme

Costs Budgeting and Costs Management – What You Need To Know

Essential background on CPR 3.15 costs management rules and procedures that practitioners need to understand the NOx judgment

Reasonable Joint Costs Recoverable In Full Regardless Of Number Of Defendants

Recent High Court decision (2025) on common costs in multi-party litigation, relevant to the GLO cost recovery issues

Budgets, Hourly Rates, Good Reason and Proportionality

Analysis of how courts assess reasonable and proportionate costs under CPR 3.18, relevant to the budget assessment principles

Significant developments and incurred costs

Chief Master Marsh decision examining costs budgeting practicalities and significant development applications

![FERNANDEZ V FERNANDEZ [2025] EWHC 2373 (Ch)](https://tmclegal.co.uk/wp-content/uploads/2025/09/Willis-Title-copy-copy-copy-copy-6.jpg)

![STOCKLER AND ANOTHER V THE CORPORATION OF THE HALL OF ARTS AND SCIENCES [2025] EWHC 2262 (SCCO)](https://tmclegal.co.uk/wp-content/uploads/2025/09/YT-Thumb-300x169.webp)